The Doing Good Index (DGI) 2024 evaluates the environment for social investment in Sri Lanka across four sub-indexes: Regulations, Tax and Fiscal Policy, Procurement, and Ecosystem. Here’s a summary of Sri Lanka’s performance compared to the Asia average:

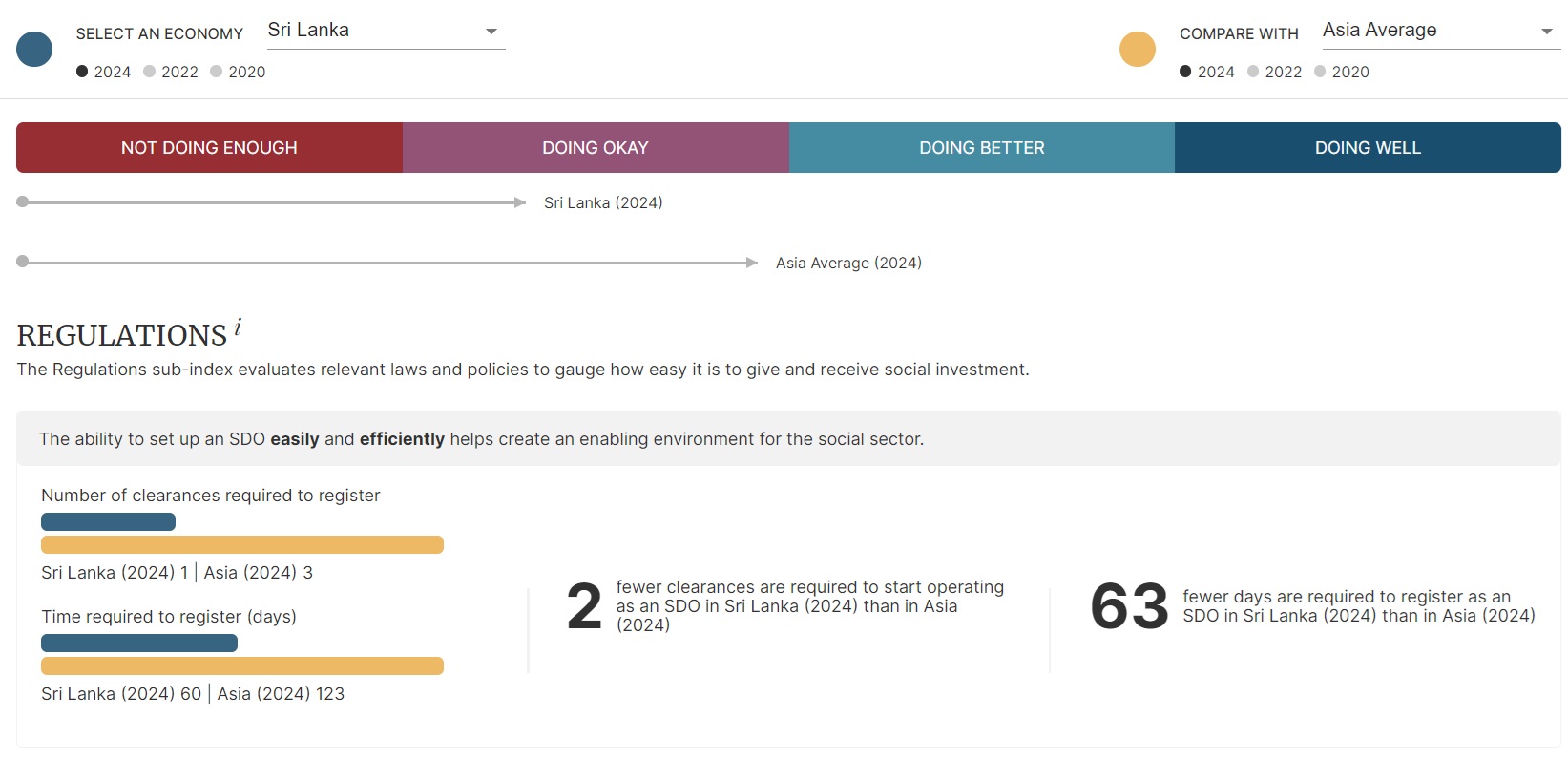

1. Regulations:

- Number of Clearances Required to Register: Sri Lanka requires only one clearance to register a Social Delivery Organization (SDO), compared to the Asia average of three.

- Time Required to Register: It takes 60 days to register an SDO in Sri Lanka, significantly less than the Asia average of 123 days.

- Receipt of Funds: There are no restrictions on receiving foreign or local funds in Sri Lanka. 57% of SDOs in Sri Lanka receive foreign funding compared to 41% in Asia.

- Accountability and Transparency: 78% of SDOs in Sri Lanka believe laws are enforced, higher than the Asia average of 63%. Only 20% of SDOs find the laws easy to understand, above the Asia average of 12%.

- Policy Consultation: 10% of SDOs in Sri Lanka are regularly involved in policy consultations, compared to 14% in Asia. However, 77% occasionally participate, higher than the 59% Asia average.

2. Tax and Fiscal Policy:

- Tax Incentives: Both individual and corporate tax incentives for donations are fully available in Sri Lanka. The limit for individual tax incentives is 33% in Sri Lanka, higher than the Asia average of 28%. For corporate tax incentives, the limit is 20%, slightly lower than the Asia average of 23%.

- Government Grants: Only 16% of SDOs in Sri Lanka receive government grants, which is significantly lower than the Asia average of 45%.

3. Procurement:

- Government Contracts: Only 12% of SDOs in Sri Lanka receive government procurement contracts, compared to 32% in Asia.

- Access to Information and Transparency: 2% of SDOs find it easy to access information on procurement contracts in Sri Lanka, much lower than the Asia average of 13%. Additionally, only 6% find the procurement process transparent, compared to 19% in Asia.

4. Ecosystem:

- Trust and Recruitment: 48% of SDOs in Sri Lanka believe they are trusted by society, slightly higher than the 44% Asia average. Recruiting board members with corporate experience is considered easy by 34% of SDOs, compared to 32% in Asia.

- Corporate Engagement: 66% of SDOs in Sri Lanka work with corporate volunteers, higher than the Asia average of 63%. However, only 40% receive corporate funding, compared to 56% in Asia.

- Individual Giving: A high percentage (84%) of SDOs in Sri Lanka report low levels of individual giving, compared to 72% in Asia. The primary reasons are a lack of resources to donate and a preference for direct giving to beneficiaries.

- Capacity Building and Communications: Only 8% of SDOs in Sri Lanka receive consistent support for capacity building, below the 15% Asia average. Similarly, only 7% receive consistent donor support for communications strategy, compared to 9% in Asia.

- Talent Recruitment: 52% of SDOs in Sri Lanka find it difficult to recruit staff, better than the 73% in Asia. Additionally, there is a lower perception in Sri Lanka (49%) that nonprofit staff should earn less than their for-profit counterparts compared to 69% in Asia.

- Social Enterprises and Crowdfunding: 58% of SDOs in Sri Lanka report an increase in social enterprises over the last two years, compared to 46% in Asia. Additionally, 37% of SDOs are currently crowdfunding, compared to 27% in Asia.

Conclusion:

Sri Lanka shows strengths in regulatory efficiency and enforcement, with fewer clearances and less time required to register SDOs compared to the Asia average. However, challenges remain in government support and procurement transparency. The ecosystem for social investment in Sri Lanka benefits from relatively high trust and corporate engagement but faces issues in individual giving and capacity building support. The data suggests areas for improvement in policy consultation and procurement processes to better support the social sector.

For detailed insights, visit the Doing Good Index 2024.